1. An energy source

2. A processing module

3. An onboard memory module

3. A data storage module (optional)

4. A learning module

5. A controller to do stuff.

6. A communication mechanism

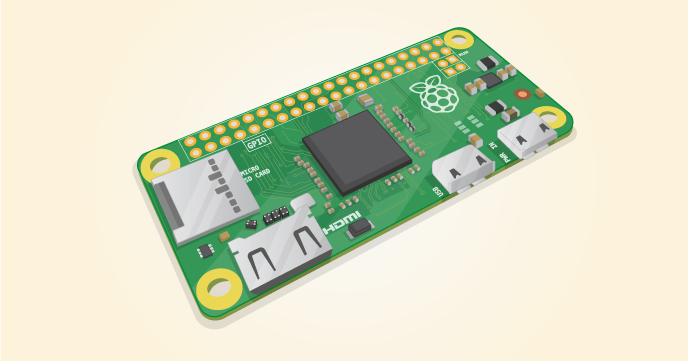

A Raspberry Pi is a good albeit incomplete reference design for this architecture. If we look at Pi Zero (https://www.raspberrypi.org/products/pi-zero/), which is selling for a mere $5, it includes the bare minimum elements required to fulfill such an architecture.

Included elements in Pi Zero

Out of the box Pi Zero includes a processing module with interfaces that can be used to plug in other modules.1. An energy input interface (Micro USB power)

2. A processing module (1Ghz, Single-core CPU)

3. An onboard memory module (512MB RAM)

3. A data storage module interface (A Micro SD card slot)

4. A learning module (We can deploy R or Python on a Pi Zero)

5. A controller interface (HAT-compatible 40-pin header)

6. A communication mechanism interface (Mini HDMI and USB On-The-Go ports to plug in USB dongle)

Given the above, the Pi Zero is an excellent prototype of how these architectures will evolve. As can be noticed from above, these interfaces while allowing flexibility, lack the full build out of the architecture. In many ways, the Pi Zero unit is going to be the brick of the world of Internet of Everything.